Competitive Intelligence/Insights is probably one of the most important business topics. Chances are that you have not met a salesperson, a business leader, or an investor who doesn’t care about competition and differentiation.

The reality is that competitive analyses and insights remain are subjective and complex. In the corporate strategy teams at typical large corporates (Fortune 500 companies), I have worked with folks who are full-time employees in the CI (competitive intelligence) teams to manage the complexity of our competitive landscape across multiple products and/or lines of businesses.

At tech startups and growth-stage companies, including well-funded and revenue-generating startups, competitive analysis becomes a part-time job of product managers (PM) and product marketers. The challenges of the broad nature of the task, manual tasks, and a constantly moving target, lead to suboptimal competitive insights.

This leads to Sales teams, one of the key internal stakeholders, to form their own opinions. Most often these opinions are based on day to day customer conversations as opposed to rigorous analysis because competitive analysis is not their job either. To add to the challenge, existing and new potential competitors continue to ship more products and join your competitors’ club making the task much harder.

In order to avoid these pitfalls, a product manager (PM) or a product marketing manager (PMM) needs to set two key objectives of the competitive analysis:

1.To “build and manage insights” and “make decisions”, and not just to “search and distribute data or opinions on competitors”

2.To obsess about customers and the value offered, and not about competitors

These objectives are well-understood by the thought leaders from other industries too (HBR article). Competitive analysis with the right objectives helps a PM or PMM to focus (or obsess) on their customers and the value delivered instead of just reactive monitoring of the competitors.

Competitive Insights For Customer Focus And Value Delivery

Given all the demands on time, a PM/PMM must focus on key objectives or insights instead of an open-ended competitive analysis and restate the objectives in customer value questions (cv)):

- Maintaining/building product differentiators (cv: What unique value do I deliver to my customers?)

- Analyzing your product’s strengths and weaknesses with your competitors’ (cv: What is the potential customer value delivered/not delivered by my competitors?)

- Understanding the optionality or alternatives available to your customers (cv: What are the different ways for customers to seek value?)

- Right positioning against competitors (cv: What is the level of customer awareness of the value of my product?)

- Product/sales collateral for the potential (current) customers (cv: How do we communicate the value offered to customers?)

- High-level understanding of the industry and participants (cv: What is the current landscape of customer needs?)

- Opportunities and Threat to your product/business (cv: What could be the changes in the landscape of my product industry?)

And so on… Given the breadth of competitors' data gathering and analysis, it’s important to focus on 1–2 questions/objectives at a time, preferably state them in the form of customer value and then start the competitive analysis.

Breadth of Competitive Analysis and Sources of Information

Competitive analysis is a broad topic because it includes a lot of information and a bunch of manual tasks. A number of tools, including Google search and social media, that provide easy access to company-level, sales, and marketing information.

- Identifying competitors: Company information, size, funding, # of employees, # of open positions, etc.

- Marketing tactics: Content strategy, level of engagement, marketing promotions, social media, etc.

- Customer success tactics: Depth of solutioning, product customizations, account management, tech support, etc.

- Sales tactics: Sales processes, sales partnerships/reselling, sales channels, etc.

Traditionally, in the outbound sales context, much of this info has been utilized by a salesperson who establishes a relationship with a potential client and educates them about other potential competitors. Typically, your sales people need competitive battle cards that should provide them the most pertinent information on competitors and their solutions.

Although, outbound sales tactics have become less effective. Now, the customers conduct their own research on potential products before getting ready to speak with a salesperson, that is, the rise of inbound go-to-market (GTM). The inbound GTM process primarily relies on the publicly available data that is quite reliable. A typical customer becomes largely aware of their needs through research and seeks the desired product capabilities. Today, customers can access a broad range of info on competitors:

- Gartner and Forrester provide high-level capabilities comparison of a few selected companies. New entrants, like, CBInsights provide high-level information on hot trends like, “Artificial Intelligence”, “Deep Learning”, etc. Social platforms like LinkedIn provide info on # of employees, employee growth rates, etc. and databases like Crunchbase provide funding, M&A, and other company level info.

- The product capabilities and related details are embedded in the content — blogs, videos, and other digital marketing tools that customers access through social media, search engines, and other tools.

For a PM/PMM, it is important to understand customers’ perspectives on competition and how to influence it

For PM and GTM teams in a company, there are no tools that provide an accurate and objective assessment of the different product capabilities offered or on the strengths and weaknesses of the products. The product level details remain largely embedded in numerous digital content pieces published. This is where a PM/PMM can help the most and provide competitive insights to their Sales/marketing teams.

Best Approach for Competitive Analysis

- Defining product capabilities: A PM’s ability to carefully define and manage the scope of product capabilities for competitive analysis is the first key step. This answers the question: What value (through our unique capabilities) do we deliver the best? A well-defined domain provides a better focus throughout the research and analysis. In my recent experience, we were defining a product that was similar to the social media buying tools — there are probably 100s of them. Although, as the PM leader, my vision was to offer capabilities that were quite different from the core capabilities of a typical social media buying tool. Hence, I focused on capabilities such as, media planning, automation, dynamic creatives, personalized ads, etc. for competitive analysis.

- Stating objectives and potential insights: A PM needs to define the objectives of the analysis — a few potential questions that need to be addressed. As addressed in the earlier section, one size fits all approach would most likely end up in weak/subjective results. Hence, it’s important to focus on a few questions that need to be addressed —am I addressing potential white spaces in my product roadmap OR how would I build a SWOT analysis to influence my stakeholders?

- Prioritizing sources of info: There are no direct sources for info on product capabilities. Identification of sources and research of data requires planning for a manual effort by the PMs and their research teams. Typically, product capabilities can be best understood by trying the software but that may not be always possible. Other common sources are websites, blogs, social media posts, Google Search, etc. Some of this research helps create a baseline of competitive product capabilities and then more specific data can be gathered through people who have knowledge of those products. Nowadays, a lot of companies are recording their sales calls in sales intelligence tools, and a lot of competitive info may be available in these sales recordings.

- Gathering competitive info: After sources are identified, a PM would gather info on the competitors. In my experience, I have typically conducted a focused competitive analysis once every 6–8 weeks. Hence, standardizing some manual steps of data gathering and analysis helps save time. When the data is gathered with a set of targeted competitive intelligence questions and potential sources, one can manage the scope better without getting lost in the details. This is also largely a manual step for PMs and takes a significant amount of effort to collect and cleanse the data manually, typically, in the spreadsheets and other documents.

- Analyzing data: Once clean and aggregated data is ready, it can be modeled and analyzed to address the specific objectives. In terms of modeling the data, I would assign a higher credit to information passed by customers through testimonials and other ways. During analysis, at times, I have realized that it may not be possible to address all the targeted objectives and questions due to a lack of data or other reasons. A PM is better off de-prioritizing or deferring (until specific data can be found) such questions that cannot be addressed objectively to avoid any subjective analysis that remains open to interpretations and opinions.

- Generating Insights: The best insights are easy to understand answers, in simple words, to the questions that are supported by data. A PM’s job is to make strategic decisions, execute on the strategy, and achieve product success. Instead of sharing analysis and visualizations that seem theoretical, I would leverage these answers to improve the overall confidence level across the teams and support harder strategic choices for the PMs and GTM teams.

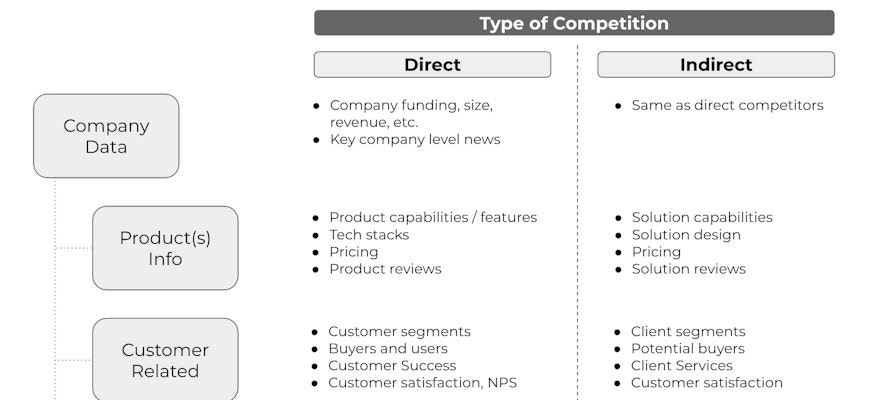

Once a PM/PMM is able to establish a structured and well-defined approach, similar to the one suggested above, they can repeat the process with a high rate of success. In addition, just like the rest of the PM responsibilities, competitive analysis requires a high degree of cross-functional collaboration. PMs collaborate with marketing and the rest of GTM teams to classify the list of competitors as direct or indirect:

- Direct or primary competitors tend to offer a similar product in a similar market aiming to solve the same problem.

- Indirect competitors offer a different product (or a solution) in a similar market aiming to solve the same problem differently.

Ideally, marketing teams maintain company-level and marketing info on competitors, which is required to be put into product context. Whenever the company-level info was needed, I used a combination of Crunchbase, LinkedIn, and CBInsights to get the high-level info and supplement with additional, specific information, for example, on content engagement or social media posts through third-party tools.

Frequency and Need for Competitive Analysis

Typically, in today’s agile product environment, a product team must conduct a targeted competitive analysis every 6 —8 weeks or at least once a quarter, depending on the speed of the market. In my experience, we were in extremely fast-paced ad-tech and mar-tech markets from 2015–2019 and we couldn’t keep up with competitive analysis. Now, most of the tech markets have become very fast-paced. The pace of the industry, and the stage of the product and the company, require competitive insights for various needs. Some of these are:

- Defending future product roadmap items and overall direction

- Addressing confusion in the market (when several companies seem to offer similar capabilities)

- Providing business arguments to Sales against/in favor of competitors

- Positioning for white spaces and for competitive topics

- Pitch decks that require more strategic views such as, SWOT

- Monitoring product trends among competitors and assessing new entrants

As a product team leader, I would establish the needs and potential questions before planning for competitive analysis and then apply the methodology as suggested in this post.